🌍 Introduction: Why Lithium Is the New Oil

As the world races toward net-zero emissions, lithium has emerged as the critical mineral powering the clean energy future. Often dubbed “white gold,” lithium is essential for manufacturing lithium-ion batteries used in electric vehicles (EVs), smartphones, laptops, and renewable energy storage. But as demand soars, so does geopolitical tension over who controls the lithium supply chain.

Table of Contents

ToggleFrom Latin America’s “Lithium Triangle” to China’s refining dominance, lithium isn’t just about technology—it’s about power.

🛢️ Lithium vs. Oil: A Shift in Global Power Centers

Historically, oil-producing nations shaped global geopolitics. Today, lithium-rich countries like Chile, Argentina, and Bolivia are becoming strategic hubs. Meanwhile, mineral diplomacy is replacing petrodiplomacy.

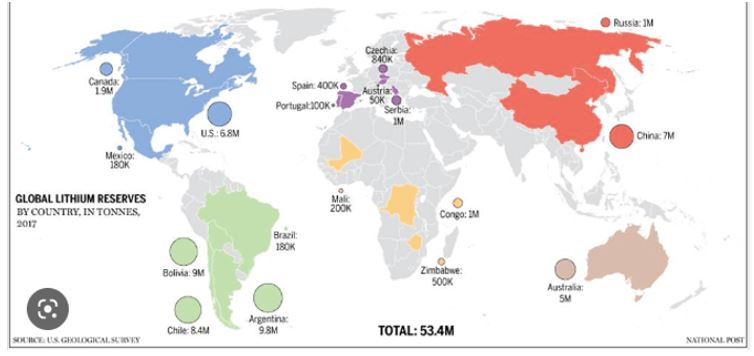

The Lithium Triangle holds over 50% of global lithium reserves.

Australia leads in extraction, while China dominates refining and battery manufacturing.

The U.S. and EU are pushing for “resource independence” to secure their green transitions.

Key shift: Energy geopolitics is no longer dominated by the Middle East but by South America, China, and Africa.

🏭 The Lithium Supply Chain: Who Controls What?

Unlike oil, lithium’s supply chain is complex and multi-stage, involving mining, refining, battery manufacturing, and recycling. Each stage is geopolitically significant.

Mining: Australia, Chile, and Argentina lead.

Processing & Refining: China controls over 60% of global capacity.

Battery Production: China dominates, followed by South Korea and Japan.

EV Manufacturing: Led by Tesla (USA), BYD (China), and European automakers.

This concentration gives China a strategic advantage—similar to OPEC’s past control over oil prices.

🌐 Lithium as a Tool of Geopolitical Influence

Control over lithium has the potential to reshape global alliances and rivalries.

🔥 Tensions & Trends:

China–US competition: The U.S. views China’s lithium dominance as a national security risk.

Resource nationalism: Countries like Bolivia and Mexico are nationalizing lithium to keep profits at home.

Supply chain realignment: The EU and U.S. are investing in local mining and battery gigafactories to reduce reliance on China.

🌱 Sustainability and Ethics in Lithium Extraction

While lithium supports green energy, its extraction has environmental and social costs:

Water-intensive mining in arid regions harms indigenous communities and ecosystems.

Unregulated mining in Africa (e.g., DRC for cobalt) raises concerns about child labor and human rights.

Recycling lithium is still in its infancy and cannot yet replace demand.

Thus, the “green revolution” must ensure it doesn’t create new environmental and ethical crises.

🚘 Future Outlook: Strategic Lithium Is Here to Stay

With EV demand projected to quadruple by 2030, lithium will remain a key geopolitical resource for decades. Expect:

Battery alliances between countries and corporations.

New trade routes and infrastructure (like lithium corridors).

Increased investment in lithium alternatives (e.g., sodium-ion batteries) and sustainable tech.

📝 Conclusion: The New Era of Mineral Geopolitics

In the age of climate change and technological transformation, lithium is no longer just a mineral—it’s a strategic asset. The countries and companies that secure access to lithium today are positioning themselves as leaders of tomorrow’s energy economy.

The geopolitics of lithium will not only define the electric vehicle revolution but also shape the global balance of power in the 21st century.